Given that a Trust provides asset protection by way of people gifting their assets to the Trustees, it is important to consider what actual assets should be transferred to a Trust. While there is normally nothing stopping any type of asset from being transferred to Trust, we suggest that you consider the following guidelines:

- Is the property we want to transfer to Trust going to appreciate in value. If not, it may be counter-productive to your Gifting Programme to transfer that type of asset;

- Is the asset one that is sensible to be managed by Trustees? Often people wish to transfer certain assets which are high-maintenance to a trust and find that it becomes cumbersome getting Trustee sign-off on all decisions relating to those assets. Therefore, consideration should be given as to the type of asset being transferred.

- Cost-Benefit Analysis. You should also consider whether the cost of documenting an asset transfer is worth the protection you may get for it. General household chattels and effects are probably not worth transferring into Trust, unless they are of such a high value that protection is warranted.

EXAMPLE

We have provided here an example of how the transfer of assets and a Gifting Programme works on a simple Family Trust scenario.

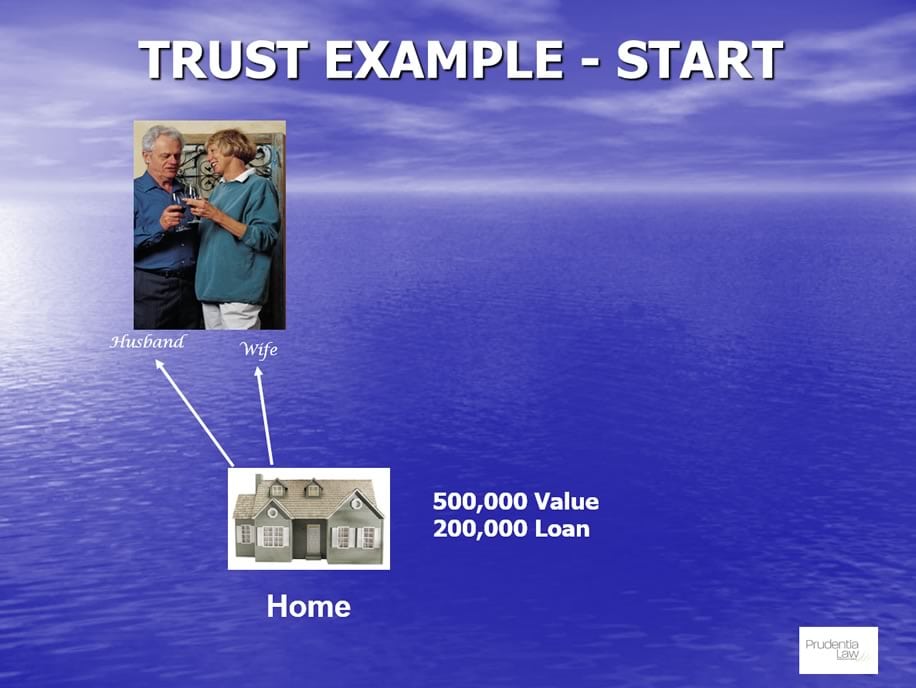

The first slide below shows a couple’s starting point, where they own a property worth $500,000 and have a loan to a bank of $200,000.

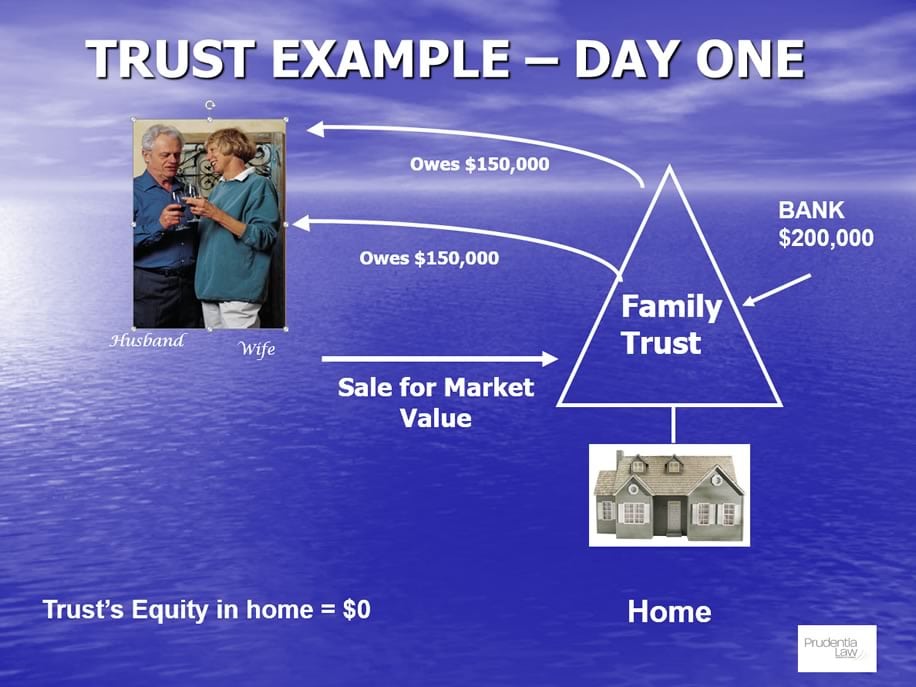

Given the property in this example is valued at $500,000, that is the purchase price that the trust must pay the couple to purchase the family home.

In the slide below, you will see that the property is transferred to the trustees for $500,000 and the loan to the bank has been refinanced into the names of the Trustees. This is the Equity Value Gifting structure discussed in our Gifting section, as you can see that it is only the Equity portion of the property that is left owing to the couple who have sold the family home to the Trust, i.e. $150,000 each. This would be documented by way of an Acknowledgement of Debt.

It is important to realize that as at day one of the trust structuring, the Trust actually does not have any equity in the property. This equity to the Trust is only achieved by way of gifting by the couple or through capital growth in the value of the property.

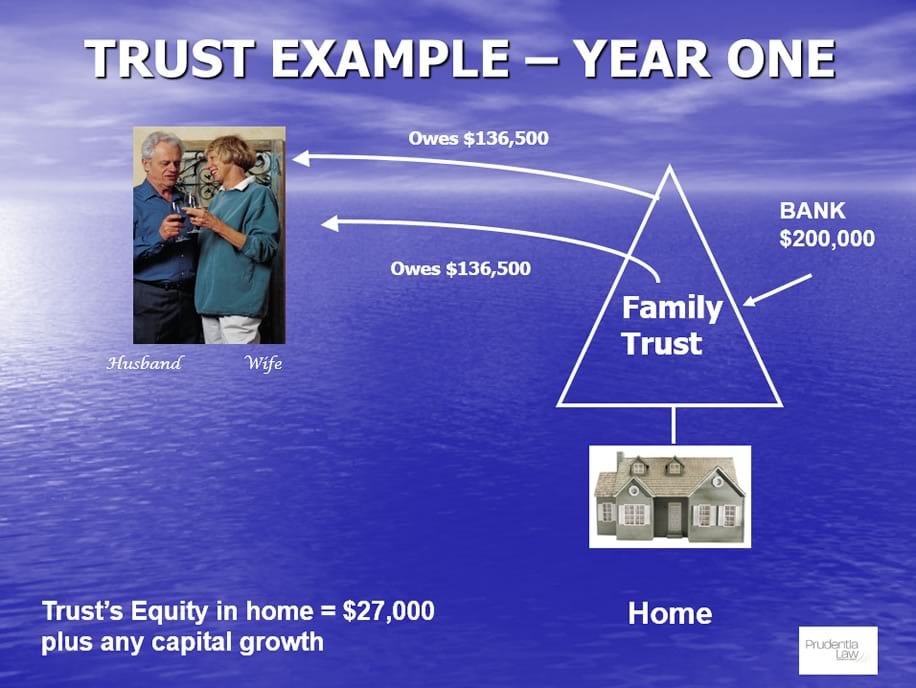

The first gift by the couple is shown in the slide below, whereby the Trust receives $27,000 of equity from the couple from them gifting $13,500 each of the loan they are owed by the trustees of the Trust for the purchase of the family home. (Please note that this couple has decided to keep within the current Residential Care Subsidy thresholds for gifting)

The Gifting would be documented by way of a Forgiveness of Debt which reduces the amount owing to the couple to $136,500 each in the first year. This first Gift is obviously undertaken at the time the Trust is formed and the property purchased into it. This then means that the couple can do a gift of $13,500 each on each anniversary of the Trust set-up, until their entire acknowledgment of debt and any other advances they have made to the trust have been forgiven.

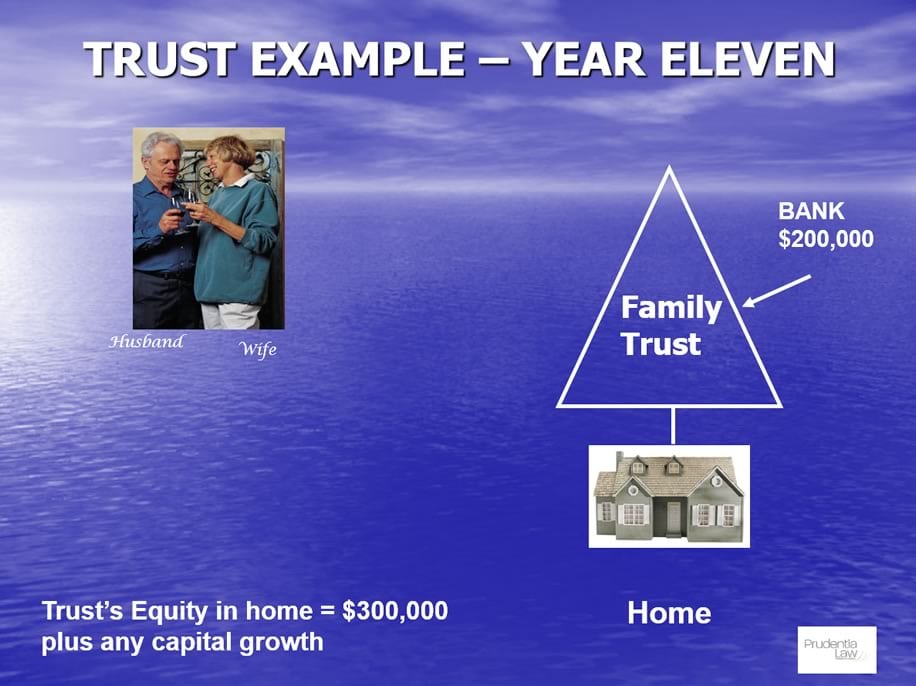

Over time then, assuming they do not repay any of the loan the Trust owes to the Bank, the couple will have completed their initial gifting programme after 10 years and 1 day. This means, as the slide below represents, the Trust will hold all the equity in the family Trust by year eleven.

Obviously, over time the husband and wife would pay off the loan that is owed to the Bank. In doing so, they are advancing further funds to the Trust which creates equity to the Trust. Because of this, the advances the couple may make to the Trust are added to their overall Gifting Programme so that eventually, once the property is freehold (without a mortgage), they will have each gifted $250,000 to the trust in respect of that family home, being 50% of the original value of the family home when it was transferred to the Family Trust.

Leave A Comment